Uncovering Hidden Digital Assets in Divorce

One of the most important goals of a divorce is to identify, value, and divide marital assets. This can be challenging when dealing with digital currency since digital currency is easy to hide and hard to trace. Additionally, once digital currency is identified, valuing may become tricky due to the extreme volatility that it has experienced over the last several years.

Because digital assets exist merely as digital code, they can be easily transferred to and from digital wallets, they can be “tumbled” or “laundered” to obscure their original source and they can be stored on external devices.

Fundamentally, digital currency is an encryption technique that is used to regulate and verify transactions. When someone obtains Bitcoin they are acquiring a piece of data that holds value. That data has value because ownership can be determined and verified. The data is then stored in a digital wallet (an individual could create hundreds of digital wallets) or on physical storage devices.

Below are some tips and tricks to help you identify if your spouse may be involved in digital currency:

(a) Mining hardware:

Mining involves using hardware and other resources (electricity) to solve extremely complex math problems associated with the digital currency blockchain, which ultimately serves to verify digital currency transactions. If your spouse has a lot of complicated computer hardware that is running 24/7, he or she may be mining digital currency.

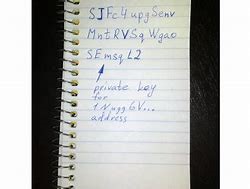

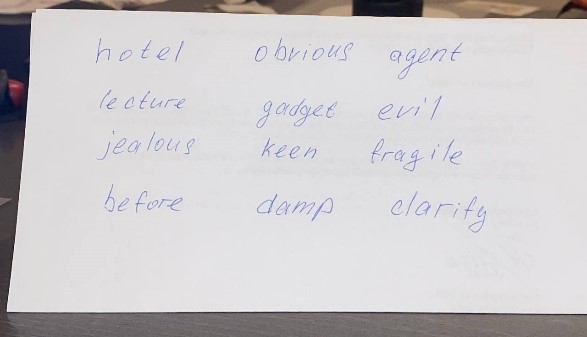

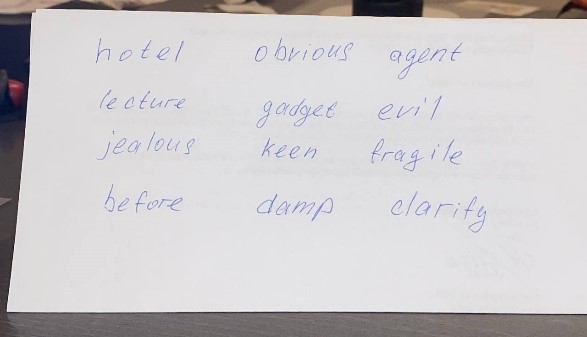

(b) Private key and recovery seed:

All digital wallets and physical storage devices have a private key, which is essentially a password. Each private key has a “recovery seed”, which consists of a random 12 or 24-word recovery phrase that is used in the event the private key is lost or forgotten. If you locate these items, that is a good indicator that your spouse has digital assets.

Figure 1 Example of a private key

Figure 2 Example of a recovery seed

(c) Tax Returns:

Another way to determine the existence of digital currency is to inspect your spouse’s tax return. As of 2019, the Internal Revenue Service (“IRS”) now requires information regarding digital currency during the tax year.

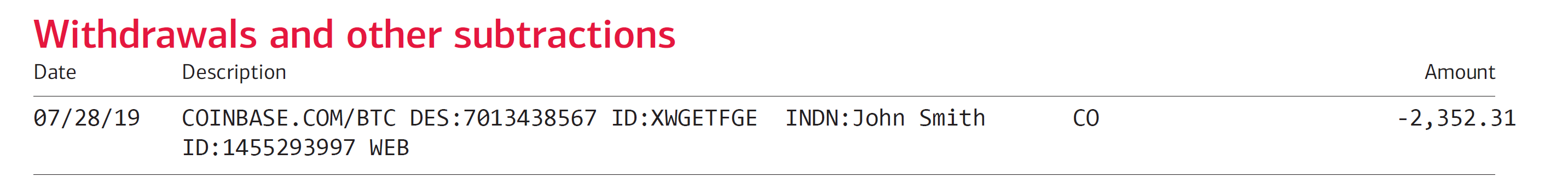

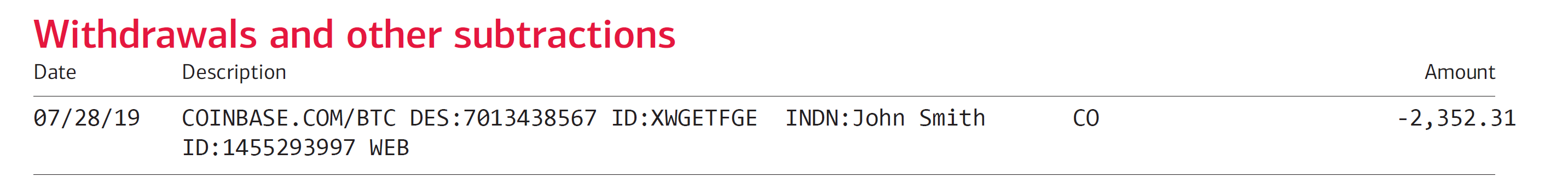

(d) Bank and Credit Card Statements:

There are countless ways to acquire digital currency, from crypto mining with computers to bitcoin ATM machines at gas stations. However, the most popular method to purchase digital currency is on a digital currency exchange such as Coinbase or RobinHood. In order to purchase assets on these platforms, a credit card or bank account must be linked to a digital currency exchange, and evidence of transactions may be present in the account statements. Searching for the word “coin”, “crypto”, “Robinhood” or “Coinbase” “Coin switch”, “Binance” and “FTX2” are a few of the cryptocurrency exchanges to look out for on bank and credit card statements.

Figure 3 Example bank account statement showing digital currency investment

Because digital assets are still relatively new and unregulated, there are currently no specific laws addressing digital assets in the divorce context in Pennsylvania. However, these assets can be incredibly valuable, and failing to identify and properly value them, could cost you.

For further guidance on digital assets in the context of divorce, or if you are concerned about how your spouse’s digital assets could affect your divorce, please set up a consultation with a member of our Family Law Team.

The information contained in this publication should not be construed as legal advice, is not a substitute for legal counsel, and should not be relied on as such. For legal advice or answers to specific questions, please contact one of our attorneys.